You can help stop the proposed Constellation/EDF deal.

But time is of the essence and the final vote could happen any day.

1. Call Maryland PSC Chairman Doug Nazarian at 410-767-8073 and tell him “NO DEAL for Constellation and EDF”! Marylanders do not need or want an extraordinarily expensive $15 billion nuclear reactor, decades of needlessly high electricity rates, a French company with a history of questionable business practices, nor a $33 million golden parachute for Constellation’s CEO—the same guy who nearly brought Constellation to bankruptcy just one year ago.

2. Send an e-mail or fax to Maryland Governor Martin O’Malley. On September 16, Governor O’Malley wrote an op-ed in the Baltimore Sun opposing this deal. You can read this op-ed here. The Governor is definitely getting pressure from the other side, so we need your help to make sure Gov. O’Malley continues to stand strong against this deal and continues speaking out against it.

3. Send an e-mail to your state legislators. They should raise their voices against this deal now.

4. Contact the Chesapeake Safe Energy Coalition for more information or to get more involved. Write to nirsnet@nirs.org.

5. See our Baltimore Sun ad.

Would Calvert Cliffs-3 really cost $15 billion, or more?

Yes and Constellation Energy’s own construction cost estimates for Calvert Cliffs-3 continue to skyrocket.

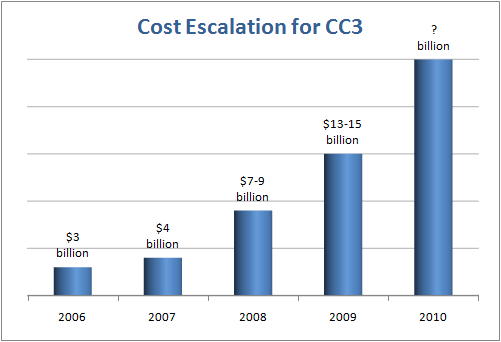

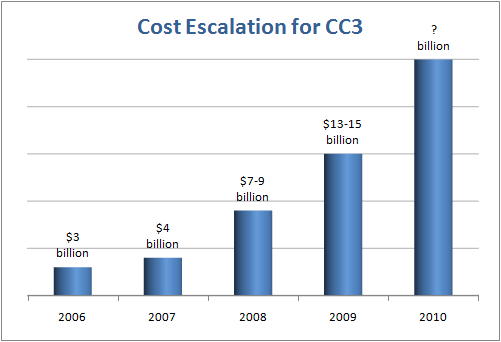

In early 2006, the industry’s Nuclear Energy Institute said a new reactor could be built for about $2 to $3 billion. As recently as December 2007, Constellation’s estimate was about $4 billion for Calvert Cliffs-3. But by the summer of 2008, company officials testified to the Maryland Public Service Commission that the reactor would cost in the range of $7.2-$9.6 billion. And in the summer of 2009, Constellation CEO Mayo Shattuck testified that the reactor would cost “about $10 billion” not including financing and other costs.

How much could these additional costs add? According to the website of PPL, a Pennsylvania utility considering a reactor identical to Calvert Cliffs-3, the price tag for the reactor including financing and other costs would be between $13 and $15 billion.

But even those estimates may be optimistic. Cost overruns on nuclear reactor projects are so frequent that they are the rule, not the exception. Indeed, a 1986 study by the U.S. Department of Energy found that the average cost overrun for the first 75 U.S. reactors was 207%.

Huge cost overruns, despite the enormously inflated prices for new reactors, continue to be the norm. The first Areva EPR reactor—the French design chosen for Calvert Cliffs-3—is now being built in Finland. Its initial 2005 estimate was about $4.5 billion; after four years of construction the estimate has increased by 75%, to nearly $8 billion, and it is currently three years behind schedule.

In September 2008, Constellation Energy crashed. Its stock, which had been trading for about $100 per share in January 2008, plummeted to near zero, and the company was on the verge of bankruptcy when Warren Buffett rode in to save the day, lending Constellation one billion dollars as part of a deal to buy the company for $4.7 billion.

The man who led Constellation Energy into that crash was CEO Mayo Shattuck.

A lot of executives would have been fired for taking a profitable company to the verge of bankruptcy in less than a year. Not Mayo Shattuck.

We’ll never know if Buffett would have kept Shattuck in his job. But when it looked like Warren Buffett might nix the idea of building Calvert Cliffs-3 (Buffett had previously examined the idea of building a new reactor in Idaho, and concluded it made no economic sense for either the utility or for ratepayers), Shattuck and his friends at Electricite de France came up with a new idea. EDF would invest $4.5 billion in Constellation by buying 49.9% of Constellation’s five existing nuclear reactors.

The Buffett deal successfully scuttled, and blame for Constellation’s crash apparently forgotten, Shattuck is set to reap his reward: a $33 million golden parachute once he turns 55 (which happened to be October 7th).

The Maryland Public Service Commission is considering, if it approves the Constellation/EDF deal, granting a one-time $56 million rate rebate to BG&E customers. That’s right: BG&E’s million customers would get to split $56 million—that’s about $56 each; Mayo Shattuck gets to walk away with $33 million. Great deal for Shattuck; another reason to say NO DEAL to Constellation/EDF.

How would this deal lead to decades of needlessly

high electricity rates?

If the Constellation/EDF deal goes through and Calvert Cliffs-3 is built, your electricity rates could skyrocket.

Here’s why:

The biggest factor determining costs of electricity from a nuclear reactor is the cost to build that reactor. To put a $15 billion reactor into context, the two existing reactors at Calvert Cliffs cost a grand total of $766 million—for both of them!

Together, they generate about 1700 Megawatts of electricity. That’s about $450 per kilowatt of electricity. For its $15 billion, Calvert Cliffs-3 would generate about 1600 Megawatts of electricity. That’s about $9,000 per kilowatt of electricity. That means Calvert Cliffs-3 would cost about 20 times more per unit of electricity than the two existing reactors.

Of course, those two reactors were built more than 30 years ago, and everything was cheaper then. But if prices had increased at the rate of nuclear reactor construction costs, we’d be paying $20 for a gallon of gas and the average house would cost more than a million dollars!

The average BGE residential customer currently pays 11.97 cents per kilowatt/hour for electricity. An August 2009 study by the California Energy Commission projects that the cost of electricity from a new nuclear reactor coming online in 2018—about when Calvert Cliffs-3 could come online—would be 34.24 cents per kilowatt/hour—nearly three times as much.

But that study was based on a reactor built for $3950/kilowatt, and Calvert Cliffs-3 is projected to cost about $9,000/kilowatt!

Constellation Energy claims that because Calvert Cliffs-3 would operate in a deregulated electricity environment, its electricity will be sold at the prevailing market prices, and thus won’t be more expensive than the competition. That’s nice in theory; in practice it doesn’t work quite that way—especially because Constellation won’t be able to even produce power at a competitive rate, much less sell it at current market prices.

There are three possible outcomes for ratepayers if Calvert Cliffs-3 is built:

1) The competitive market works and Constellation can’t sell electricity at a price high enough to cover its costs and repay its $15 billion in taxpayer-guaranteed loans. Constellation goes bankrupt, defaults on its loans, and taxpayers pay the loss.

2) Constellation sells some of its electricity on the open market at a loss—hoping prices rise later—but sells the bulk of its electricity to its wholly-owned subsidiary Baltimore Gas and Electric. BGE then goes to the Public Service Commission for a whopping rate increase to cover those costs.

3) The competitive market breaks down. Instead of providing substantially cheaper electricity, other generators raise their prices so that they are just under Calvert Cliffs-3 prices. Thus, instead of leading to lower prices, Calvert Cliffs-3 is most likely to cause prices to rise for everyone, regardless of where their electricity comes from.

Here’s how this might work. Say 1600 MW of electricity from Calvert Cliffs costs 35 cents/kwh. A competitor using wind energy can provide it at 8 cents/kwh, while a coal plant is providing it at 12 cents/kwh and a gas plant can provide it at 15 cents/kwh. All are selling to the same interconnected PJM grid which services Maryland and the mid-Atlantic states. Why should the wind, coal and gas generators compete with each other when the biggest kid on the block—Calvert Cliffs-3—is so much more expensive? All three could sell their electricity for 30 cents/kwh and still undercut the nuclear plant while reaping huge profits at ratepayers’ expense.

Since Constellation, and its Calvert Cliffs-3 reactor, would be such huge providers of electricity, they could essentially set the market rates to suit themselves.

Adding a hugely expensive nuclear reactor to the grid is certain to cause a massive increase in electricity rates.

Sleazy Business Practices?

Constellation Energy and Electricite de France (EDF) are already 50/50 partners in UniStar Nuclear, which exists solely to build new nuclear reactors in the United States. EDF is also already the largest single shareholder in Constellation Energy. This new deal would, for all practical purposes, merge the two companies, and Constellation would be playing second-fiddle to the much larger EDF—85% owned by the French government—along with its partner Areva—also 85% owned by the French government.

To learn more about the questionable business practices and histories of these two French government entities, check our factsheet here.

TAKE ACTION!

You can help stop the proposed Constellation/EDF deal. But time is of the essence and the final vote could happen any day.

1. Call Maryland PSC Chairman Doug Nazarian at 410-767-8073 and tell him “NO DEAL for Constellation and EDF”! Marylanders do not need or want an extraordinarily expensive $15 billion nuclear reactor, decades of needlessly high electricity rates, a French company with a history of questionable business practices, nor a $33 million golden parachute for Constellation’s CEO—the same guy who nearly brought Constellation to bankruptcy just one year ago.

2. Send an e-mail or fax to Maryland Governor Martin O’Malley. On September 16, Governor O’Malley wrote an op-ed in the Baltimore Sun opposing this deal. You can read this op-ed here. The Governor is definitely getting pressure from the other side, so we need your help to make sure Gov. O’Malley continues to stand strong against this deal and continues speaking out against it.

3. Send an e-mail to your state legislators. They should raise their voices against this deal now.

4. Contact the Chesapeake Safe Energy Coalition for more information or to get more involved. Write to nirsnet@nirs.org.

|